Standard Glass Lining share price target: Engineering equipment maker, Standard Glass Lining specializes in the production of engineering equipment for the Chemical and pharmaceutical sectors.

The company provides end-to-end solutions and has a comprehensive range of products including Separation, and Drying Systems, plant, Engineering, and Services, utilizing advanced glass-lined, Stainless steel and nickel alloy, Reaction Systems, and more.

Here we’ll discuss Standard Glass Lining’s share price target for 2025,2026,2027, and 2030 to understand growth prospects in the long run.

Let’s get started to explain!

Standard Glass Lining Share Price Target: Market Overview

- Open : Rs 172.00

- Previous Close: Rs 140.00

- 52-Week High: Rs 172.00

- 52-Week Low: Rs 140.00

- Volume : 45,302, 299

- V WAP : 171.96

- All-Time High Rs 00

- All-Time Low Rs 00

- Upper Circuit; Rs 206.40

- Lower Circuit: Rs 137.60

- Book Value: per share

- Face Value: ₹ 10.00

- Market Cap: ₹ 478 crore

Standard Glass Lining Share Price Target 2025 to 2030

| Standard Glass Lining Share Price Target Year | Min. Est. Target | Max. Est Target |

| 2025 | 200 | 215 |

| 2026 | 250 | 270 |

| 2027 | 310 | 325 |

| 2028 | 375 | 390 |

| 2029 | 460 | 480 |

| 2030 | 590 | 630 |

Standard Glass Lining Share Price Target 2025

The share price target of Standard Lining for 2025 is anticipated to reach up to Rs 200 while in the strong growth sentiment of market could be reach at Rs 215. Now, we’ll explain inherent strengths, risks and challenges that could influence financials and profit margin growth in the mid to long term.

Competitive Market:

In the highly competitive landscape, the company’s strategic expansion plan, advanced technological capabilities, and innovative approach give a competitive edge against peers.

Growth Potential :

Ahead of strong government-supportive policies, the pharmaceutical and chemical sectors are seeing robust growth. It could create market demand for specialized engineering equipment producers and generate impressive revenue.

Also Read: Ventive Hospitality Share Price Target

Standard Glass Lining Share Price Target 2026

Standard Glass Lining share price for 2026 could be reach between Rs 250 and the higher price target Rs 270 ahead of consistent growth in revenue. Here’s a detailed analysis of key factors that can affect revenue and profit margin in long run.

Raw Material cost Fluctuation

With high dependency for key raw materials on limited suppliers, any change can result in higher cost of operations and a down in revenue as well as Standard Glass Lining share price targets.

Regulatory Concern

Supportive Government policy and initiatives boost manufacturing sectors, any change in the policy could negatively impact revenue and profit.

Standard Glass Lining Share Price Target 2027

The share price target of Standard Lining for 2027 is anticipated to reach up to Rs 310 while in the strong profit growth sentiment, it could be reach at Rs 325. Now, we’ll explain inherent strengths, risks and challenges that could influence financials and profit margin growth in the mid to long term.

Economic Slowdown

International and domestic market slowdown can create an adverse effect, on industries like glass-lined equipment and down investors’ confidence which could lead to lower demand and share price targets.

Standard Glass Lining Share Price Target 2030

The share price target of Standard Lining for 2030 is expected to reach up to Rs 590 while in the strong revenue growth perspective, it could be reach at Rs 630. Now, we’ll explain inherent strengths, risks and challenges that could influence financials and profit margin growth in the mid to long term.

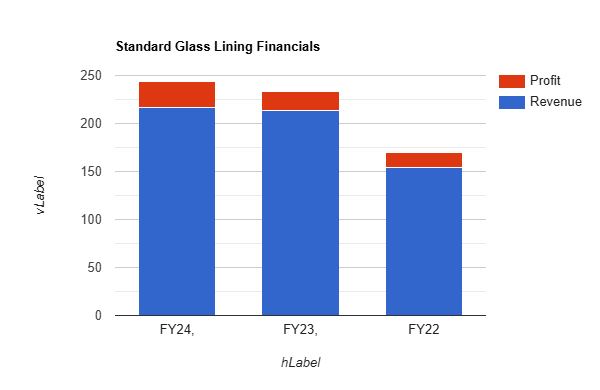

Standard Glass Lining Financial Health

Standard Glass Lining announced FY24 financial results: In FY24, the company’s profit after tax 9 percent increased to Rs 60 crore, and revenue from operation rose 9 percent to Rs 544 crore year on year basis while in the six-month, Standard Glass Lining posted revenue from operation of Rs 307 crore and net profit after tax Rs 36 crore during September 2024.

| Particulars (In cr.) | FY24 | FY23 | FY22 |

|---|---|---|---|

| Revenue | 217.1 | 213.7 | 154.0 |

| Operating Profit | 36.5 | 32.1 | 23.8 |

| OPM(%) | 16.82% | 15.04 | 15.46 |

| Net Profit | 26.4 | 20.1 | 15.7 |

Standard Glass Lining Financial Graph

About Standard Glass Lining Ltd.

Standard Glass Lining Technology Ltd. engaged in the business of manufacturing engineering equipment, offers turnkey solutions.

The company has dominated the market with its strategically located eight manufacturing plants in Hyderabad, Telangana, and sales offices throughout India.

Its wide range of product portfolio includes Drying systems, Plant, Engineering, and services, as well as stainless steel, and nickel alloy materials.

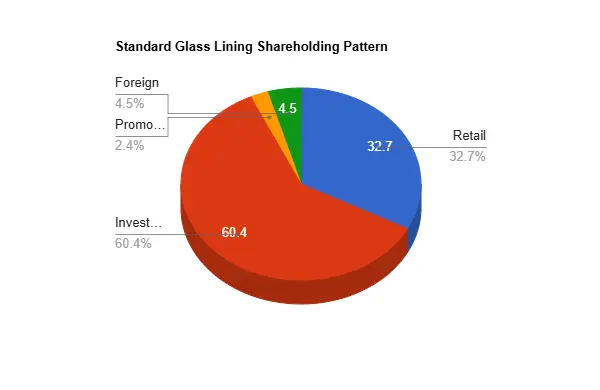

Standard Glass Lining Shareholding Pattern: Report

Shareholding Pattern Ownership

- Retail Investors 32.7%

- Promoters 60.4%

- Domestic Institutions 4.5%

- Foreign Institutions 2.4%

Standard Glass Lining: Peers

| Particulars | CPM(Current Market Price) | Market Cap |

| Standard Glass Lining | 172 | 478 crore |

| Jyoti CNC Automation | 1162 | 26,425 crore |

| Jupiter Wagons | 422 | 17,927 |

| Titagarh Rail | 1000 | 13,483 |

FAQ of Standard Glass Lining

Q1. What is the Standard Glass Lining share price target in 2025?

The Standard Glass Lining Share Price target for 2025 is expected to reach Rs 200 and it could grow up to Rs 215 due to better expectation revenue.

Q2. What is the share price target of Standard Glass Lining in 2026?

The share price target of Standard Glass Lining in 2026 will expect to reach Rs 250 while in the bull run case Rs 270.

Q3. What is the Standard Glass Lining share price target in 2030?

The share price target of Standard Glass Lining for 2030 will expect to reach Rs 590 while in the bull run case Rs 630.

Final Words

Standard Glass Lining Technology Ltd, provides manufacturing engineering equipment and turnkey solutions. It offers a wide range of products including, Drying systems, Plant, Engineering, and services, as well as stainless steel, and nickel alloy materials.

Disclaimer

The information and insights provided in the article are based on my research and experiences. This is not a buy or sell recommendation. We are not SEBI-registered financial advisors, Before making any investment decisions do your own due diligence and consult with your financial advisor.

1 thought on “Standard Glass Lining Share Price Target 2025 to 2030 Detail Analysis”