Quadrant Future Tek Share Price Target: Quadrant Future Tek is a leading research-based company, developing new-generation Train Control and Signaling Systems.

The company has tie-ups with RailTel Corp. to offer KAVACH to strengthen its position in the market as an original equipment manufacturer.

To get more information, we’ll analyse Quadrant Future Tek’s share price target for 2025, 2026, 2027, and 2030, the company’s future plan, capex, expansion, and business.

Let’s get started!

Quadrant Future Tek Share Price Target: Market Overview

| Quadrant Future Tek Share Price Target Year | Min. Est. Target | Max. Est. Target |

| 2025 | 700 | 765 |

| 2026 | 890 | 930 |

| 2027 | 1100 | 1190 |

| 2028 | 1380 | 1450 |

| 2029 | 1685 | 1755 |

| 2030 | 2100 | 2230 |

Quadrant Future Tek Share Price Target 2025

The share price target of Quadrant Future Tek in 2025 could be reached between Rs700 to Rs 765 ahead of consistent financial growth. Here’s a potential growth and challenges discussed that can influence operational and financial growth in the mid to long term.

Technological Advancements: Quadrant Future Tek research-based and tech-savvy company, adopting new-edge technologies to make products and services efficient and improve capacity can boost demand and enhance operational capability.

Dependency on Singal Manufacturing Plant: Quadrant Future Tek has a single manufacturing plant that could create certain risks, like a slowdown or shutdown. It can badly affect business operations, resulting in revenue and profit margins.

Also Read: Transrail Lighting Share Price Target

Quadrant Future Tek Share Price Target 2026

For 2026, the share price target of Quadrant Future Tek could be reached between Rs 890 to Rs 930 back of significant demand in domestic and international markets. Here’s the possible risks and challenges discussed that can affect operational and financial growth in the mid to long term.

Regulatory Challenges: Changing regulatory and strict policies could increase operational costs and badly affect profit margin as well as Quadrant Future Tek share price targets.

Diversified Product Portfolio: Diversification in the product portfolio could support its promising growth prospects, adding more products can increase market demand and enhance operational productivity and revenue potential.

Quadrant Future Tek Share Price Target 2027

Ahead of strong market demand and significant order book growth, the share price target of Quadrant Future Tek for 2027 can reach up to Rs 1,100 while in the positive market sentiment Rs 1,190. Here are five key factors that could impact operations and Quadrant Future Tek share price targets.

Significant Market Position: Quadrant Future Tek has an in-house manufacturing facility to produce highly capable and innovative technology-based products that could attract customers and increase demand.

Key Raw Material Supply: Disruption in the key raw material (used in the company production), supply chain could adversely impact the company’s operation and potential revenue prospects.

Quadrant Future Tek Share Price Target 2028

The share price target of Quadrant Future Tek for 2027 can reach up to Rs 1,380 while in the positive market sentiment share price target could be Rs.1,450. Here are five key factors that could impact operations and Quadrant Future Tek share price targets.

Rules and Regulation Compliance: Changes in rules and regulations directly affect production costs and potential revenue growth.

Competitive Market: With an established manufacturing facility and strong market position, expand its product portfolio to develop advanced products to prevent collisions that could strengthen market share and improve demand.

Quadrant Future Tek Share Price Target 2029

The share price target of Quadrant Future Tek for 2027 can reach up to Rs 1685and back to strong revenue and profit margin share price target could be Rs 1755. Here are five key factors that could impact operations and Quadrant Future Tek share price targets.

Economic and Geopolitical Factors: At present global economic scenario and geopolitical conflict or trade restrictions may impact businesses, and operations, resulting in decreased revenue as well as investors’ confidence.

Dependence on key Clients or Market: Concentrated client base, the company relies on limited clients for its business. Any delay in order, increased costs, and quality-related issues could badly affect company operations, resulting in revenue and profit margin decline.

Quadrant Future Tek Share Price Target 2030

Quadrant Future Tek’s share price target in 2030 can reach up to Rs 2100 and ahead of expansion of product portfolio and capex share price target could be Rs 2230. Here are five key factors that could impact operations and Quadrant Future Tek share price targets.

Adoption of Emerging Technologies: Fast-changing pace, and evolving technology space, are crucial for Quadrant Future Tek to adopt new edge technologies to enhance product efficiency and capability. If they fail to do so, they badly disrupt operational productivity resulting down in revenue and share price.

Partnerships and Collaborations: Partnerships and collaboration with Industry leaders or specialise services and product producers could strengthen financials and increase revenue as well as open new avenues.

About Quadrant Future Tek

Quadrant Future Tek, a manufacturer of harderware that is used for the new generation Train control and signaling systems. The company also provides comprehensive products including specialty cables for railway rollingstock and naval defence sectors.

It emphasises electronic beam-irradiated cables that are fire safety, high-performance, and lightweight.

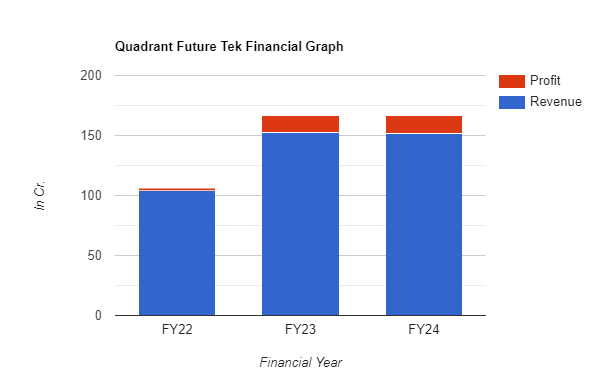

Quadrant Future Tek Financial Analysis

Quadrant Future Tek posted strong financials in FY24, with revenue from operations rising 20.6 per cent to Rs 151.8 crore in FY24 whereas the company reported revenue of Rs 104.3 crore in FY23.

The technology-driven company posted a profit after tax of Rs14.7 crore ahead of strong revenue growth and in FY23, net profit reported Rs 1.9 crore while in the first half of FY25, posted a loss of Rs 12.1 crore.

Quadrant Future Tek Earnings

| Particulars | FY22 | FY23 | FY24 |

|---|---|---|---|

| Revenue | 104.3 | 152.8 | 151.76 |

| Operating Profit | |||

| OPM (%) | |||

| Net Profit | 1.94 | 13.90 | 14.71 |

Quadrant Future Tek Financial Graph

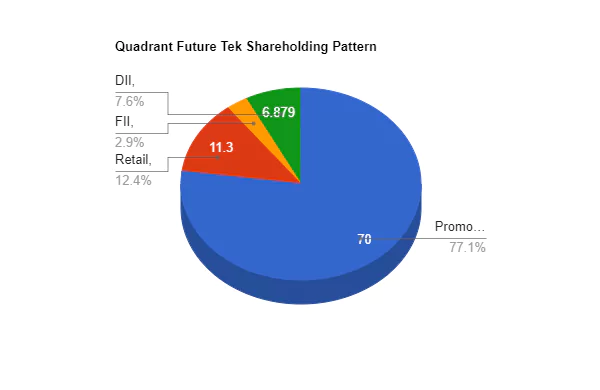

Quadrant Future Tek Shareholding Pattern

- Promoter 70%

- Retail Investors 11.3%

- Foreign Investors 2.60%

- Domestic Investors 9.23%

- Mutual Fund 4.40%

- Bank 2.27%

- Insurance 0.21%

Quadrant Future Tek Peer: Competitors

| Peers | CPM | Market Cap (In cr.) |

| Sterlite Tech | 110 | 5416 |

| Quadrant Future Tek | 579 | 2,116 |

| Birla Cable | 203.13 | 609.73 |

| AKSH Optifibere | 10.34 | 167.90 |

| T N Telecom | 10.66 | 49.16 |

| G R Cables | 40.61 | 34.99 |

FAQ of Quadrant Future Tek

Q1. What is the Quadrant Future Tek share price target in 2025?

The share price target of Quadrant Future Tek in 2025 could be reached between Rs700 to Rs 765 ahead of consistent financial growth.

Q2. What is the share price target of Quadrant Future Tek for 2026?

For 2026, the share price target of Quadrant Future Tek could be reached between Rs 890 to Rs 930 back of significant demand in domestic and international markets.

Q3. What is the Quadrant Future Tek share price target in 2030?

Quadrant Future Tek’s share price target in 2030 can reach up to Rs 2100 and ahead of expansion of product portfolio and capex share price target could be Rs 2230.

Conclusion

Quadrant Future Tek, a research and technology driven company, developed new generation Train Control and signalling Systems, provide highest level of safety and reliability solutions.

Under the KAVACH, it developed an automatic train protection system to protect train collisions.

Disclaimer

Investing in the stock market carries inherent risk. It is always advisable to consult with a qualified financial advisor or conduct thorough research on your own before making any investment decisions.

The information provided here is not intended as financial advice; any reliance on it is solely at your own risk.

Remember that stock prices can be volatile and are influenced by many factors, including market conditions, company performance, economic trends, and investor sentiment.

2 thoughts on “Quadrant Future Tek Share Price Target 2025 to 2030 Comprehensive Analysis”