Laxmi Dental share price target: Laxmi Dental Ltd. is a leading integrated dental product maker and solution provider, it provides a comprehensive product range and diversified product portfolio like custom-made crowns and bridges.

Its popular dental items include clear aligners, thermoforming sheets, and various products. The company has six manufacturing facilities, three established in Mira Road, Mumbai, two in Boisar, and one in Kochi.

This article provides Laxmi Dental’s share price target for 2025, 2026, 2027, 2028, 2029, and 2030, business, growth prospects, financial analysis, strengths, risk factors, and challenge detailed analysis. Let’s get started!

Laxmi Dental Share Price Target: Market Overview

Here’s a more detailed market overview to get an understanding. Look at this chart.

- Open : Rs 589.55

- Previous Close: Rs 491.30

- 52-Week High: Rs 584.00

- 52-Week Low: Rs 476.25

- Volume : 10,531, 297

- V WAP : 536.29

- All-Time High Rs 584.00

- All-Time Low Rs 476.25

- Upper Circuit; Rs 589.55

- Lower Circuit: Rs 393.05

- Book Value: 13.44 per share

- Face Value: ₹ 10.00

- Market Cap: ₹ 2,954 crore

Also Read: Quadrant Future Tek Share Price Target

Laxmi Dental Share Price Target 2025 to 2030

Here’s where to get Laxmi Dental share price target for 20225 to 2030 in the below table.

| Laxmi Dental Share Price Target Year | Min. Est. Target | Max. Est. Target |

| 2025 | 625 | 650 |

| 2026 | 745 | 785 |

| 2027 | 900 | 967 |

| 2028 | 1100 | 1160 |

| 2029 | 1350 | 1400 |

| 2030 | 1750 | 1830 |

Laxmi Dental Share Price Target 2025

The share price target of Laxmi Dental for 2025 is anticipated to reach Rs 625 and at the higher level share price target could reach up to Rs 650, ahead of higher growth performance. Now, look at strengths and challenges that can influence operations and financial outcomes.

What is the market capitalization of Laxmi Dental ?

The market Cap of Laxmi Dental is Rs 2000. The market capitalization is volatile ups and down even occur.

Laxmi Dental Share Price Target 2026

The share price target of Laxmi Dental for 2026 is anticipated to reach at Rs 745 and the positive sentiment case share price target reached up to Rs 785, ahead of higher revenue growth expectations. Now, discuss strengths and challenges that can influence operations and financial performance in the long term.

About Laxmi Dental

Lakshmi Dental Limited, a leading dental product provider, provides the highest quality products and services.

The Mumbai-based company began its journey in 2004, now the company has an extensive global market presence, serving clients and dentists in about 90 countries.

Laxmi Dental offers a range of advanced solutions, dedicated customer support, and standard quality, and solutions.

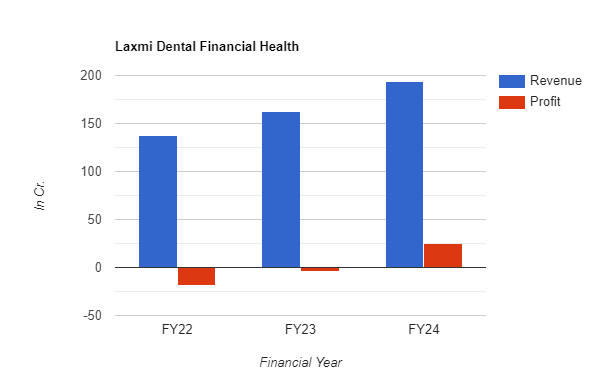

Laxmi Dental Financial Health

| Particulars | FY24 | FY23 | FY22 |

| Revenue | 194 | 162 | 137 |

| Operating Profit | 25 | 9 | 7 |

| Operating Profit Margin | 13% | 6% | 5% |

| Net Profit | 25 | -4 | -19 |

Laxmi Dental Financial Health Bar Graph

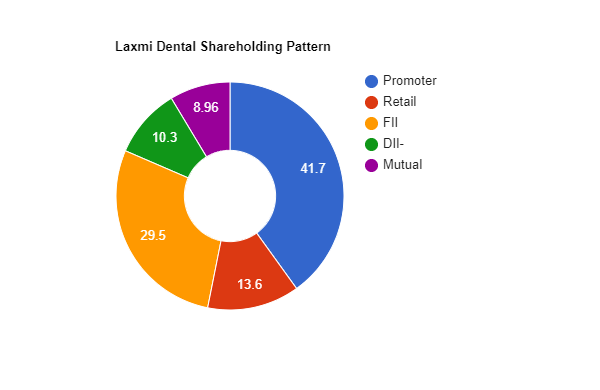

Laxmi Dental Shareholding: Report

Laxmi Dental Shareholding Ownership

- Retail Investors 13.6%

- Promoters 41.7%

- Mutual Fund 8.96%

- Others 10.3%

- Foreign Investors 29.5%

Laxmi Dental Peer: Competitors

| Companies | CMP | Market Cap |

|---|---|---|

| Laxmi Dental | 529 | 2,9111 crore |

| Medplus Health | 751 | 8,994 crore |

| Poly Medicare | 2,395 | 24,277 crore |

| Vasa Denticity | 697 | 1,159 |

| Nureca | 360 | 360 |

| Bilcare | 77 | 182 |

FAQ of Laxmi Dental

Q1.What is the share price target of Laxmi Dental in 2025?

The share price target of Laxmi Dental in 2025 is anticipated to reach up to Rs 625 and ahead of strong demand share price target would reach Rs 650.

Q2. What is the Laxmi Dental share price target for 2026?

The Laxmi Dental share price target for 2026 is expected to grow up to Rs 745 while in the higher growth, the share price target could reach Rs 785.

Conclusion

Laxmi Dental Ltd. has strong fundamentals, is a leading dental product provider, and provides a diverse range of high-quality products and services, to domestic and international clients.

The company is looking for a lucrative in the sense of a strong product portfolio and services.

Disclaimer

Investing in the stock market carries inherent risk, before investing consult with a qualified financial advisor or conduct thorough research on your own before making any investment decisions.

The information provided here is not intended as financial advice; any reliance on it is solely at your own risk.

Remember that stock prices can be volatile and are influenced by many factors, including market conditions, company performance, economic trends, and investor sentiment.

1 thought on “Laxmi Dental Share Price Target 2025 to 2030: Can this Dental Giant Deliver Explosive Growth? ”